TX 05-359 2012 free printable template

Show details

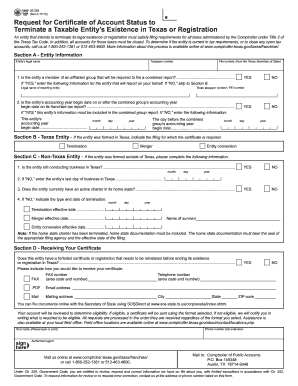

05-359 Rev.4-12/12 PRINT FORM CLEAR FIELDS Request for Certificate of Account Status to Terminate a Taxable Entity s Existence in Texas or Registration An entity that intends to terminate its legal existence or registration must satisfy filing requirements for all taxes administered by the Comptroller under Title 2 of the Texas Tax Code. O. Box 149348 Austin TX 78714-9348 Under Ch. 559 Government Code you are entitled to review request and correct information we have on file about you with...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 05 359 2012 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 05 359 2012 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 05 359 2012 form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 05 359 2012 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

TX 05-359 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 05 359 2012 form

How to fill out 05 359 2012 form:

01

Obtain a copy of the 05 359 2012 form from the appropriate source, such as a government agency or organization that requires it.

02

Carefully read the instructions accompanying the form to understand the purpose of each section and the information needed.

03

Start by filling in your personal information, such as your name, address, and contact details, in the designated spaces.

04

Proceed to complete the required fields related to your financial or legal information, such as income, expenses, or any other relevant details.

05

Double-check all the information you have provided to ensure accuracy and completeness.

06

Sign and date the form where required to certify its authenticity.

07

Make a copy of the filled-out form for your records before submitting it to the appropriate recipient or authority.

Who needs 05 359 2012 form:

01

Individuals or businesses who are required by law or regulation to provide specific financial or legal information, as outlined in the 05 359 2012 form.

02

Organizations or institutions that request this form from individuals or businesses to verify compliance or eligibility for certain benefits, services, or obligations.

03

Anyone seeking to formally report information related to their finances or legal matters as required by the 05 359 2012 form.

Instructions and Help about 05 359 2012 form

Fill form : Try Risk Free

People Also Ask about 05 359 2012 form

How do I reinstate a forfeited corporation in Texas?

Can Texas franchise tax return be filed electronically?

Can I file Form 05 359 online?

Who must file Form 05 102?

Can you file an amended Texas franchise tax return online?

Do I have to file Texas franchise tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 05 359 form?

There is not enough information to determine the exact meaning or context of "05 359 form." It could refer to a specific form used in a particular industry or organization. To provide more accurate information, please provide additional context or clarify the specific domain or purpose for which the form is being used.

Who is required to file 05 359 form?

Form 05-359 is used by Texas residents to request a declaration of their homestead property for property tax purposes. Any individual who owns a home in Texas and wishes to claim it as their homestead for property tax purposes is required to file this form with the appropriate appraisal district.

What information must be reported on 05 359 form?

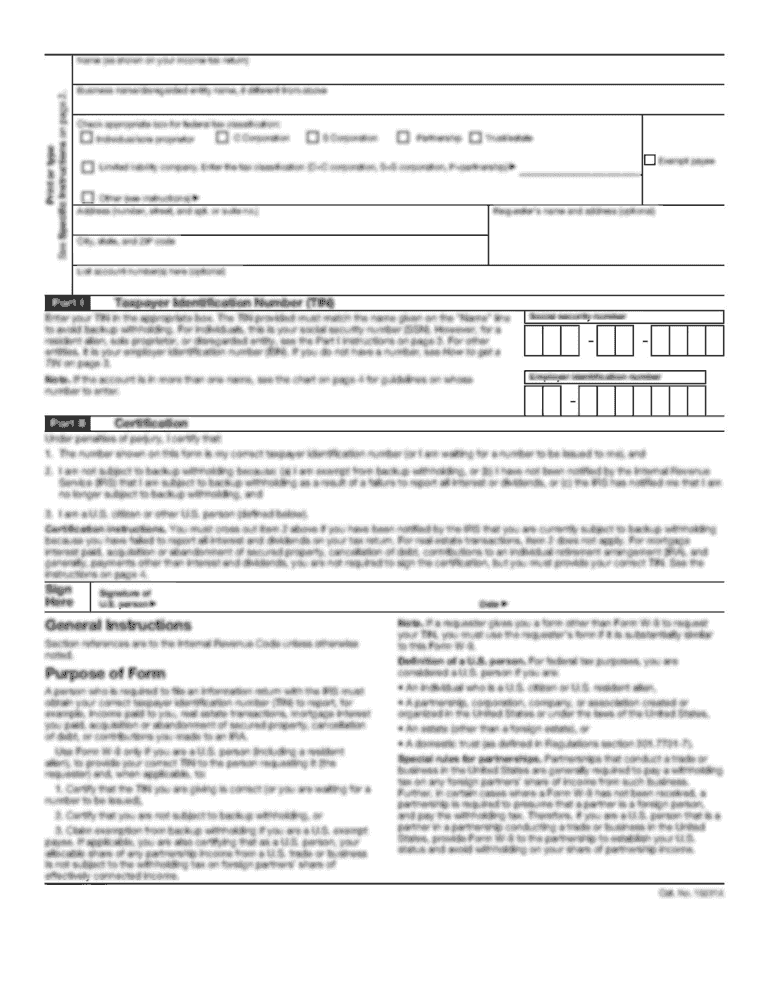

Form 05-359, also known as the Employee's Withholding Allowance Certificate, is used by employees to provide information to their employer on how much federal income tax should be withheld from their paychecks. The information that needs to be reported on this form includes:

1. Personal Information: Full name, address, social security number, and filing status (single, married, etc.)

2. Allowances: The number of allowances claimed, which determines the amount of tax withheld from each paycheck. Generally, the more allowances claimed, the less tax will be withheld.

3. Additional Withholding: If the employee wants to request additional tax to be withheld from their paycheck, they can indicate the extra amount on this form.

4. Exempt Status: In certain cases, employees may be exempt from federal income tax withholding. If eligible, they can claim exempt status by filling out this section and submitting the form to their employer.

It is important for employees to update this form whenever there are changes in their personal or financial circumstances that might affect their tax liability. This will ensure that the correct amount of taxes are withheld from their paycheck.

What is the penalty for the late filing of 05 359 form?

The 05 359 form is known as a Quarterly Federal Tax Return. The penalty for late filing of this form depends on the amount of tax owed and the duration of the delay. As of 2021, the penalty for filing the form late is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. If the return is more than 60 days late, the minimum penalty is either $435 or the balance of the tax due, whichever is smaller. It's important to note that these penalties can vary depending on the specific circumstances, so it's recommended to consult the IRS guidelines or a tax professional for accurate and up-to-date information.

How do I make edits in 05 359 2012 form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 05 359 2012 form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit 05 359 2012 form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 05 359 2012 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out 05 359 2012 form on an Android device?

Complete 05 359 2012 form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your 05 359 2012 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.